With all the disunity and infighting in Washington these days, you might think it impossible for politicians to come together about anything. Turns out that recently there are a couple of things they can agree on, both of which seem to further the cause of precious metals advocates. The primary source of agreement involves spending money they don’t have, while planning to get the money from us later. A second related activity involves creating innocuous or pleasant-sounding names for new programs, that belie the effects of said programs. Programs such as the “Affordable Health Care Act”, and more recently, the “SECURE” (Setting Every Community Up for Retirement Enhancement) Act are good illustrations. Sometimes it is not an “Act” per se, but rather a decision to backstop the pensions of a few with the funds of many (the rest of us).

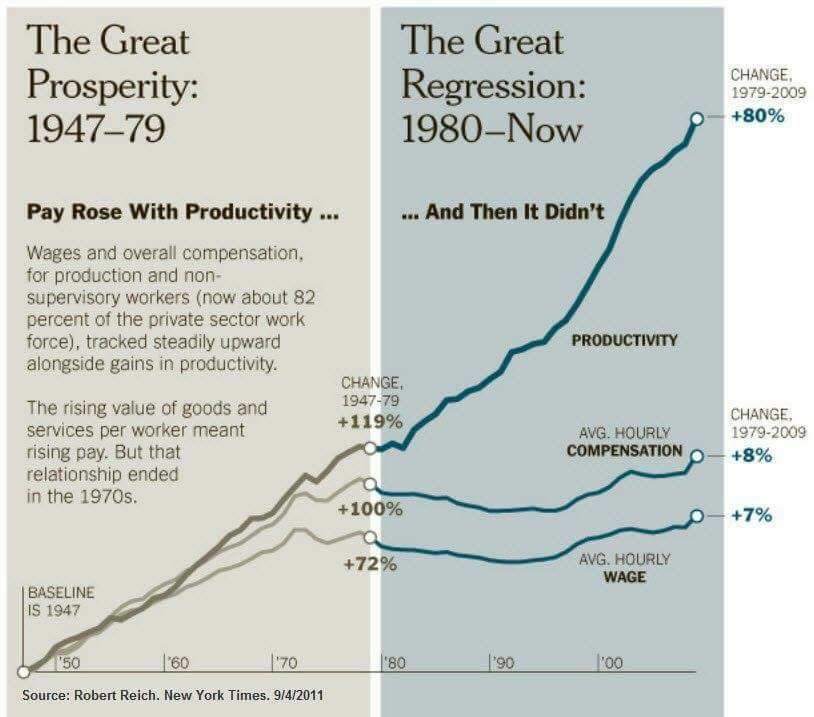

One of the problems faced by Americans these days is a “lack of money”. Whether you are talking about money for today, or money for retirement, many are clamoring for more. Research indicates that 40% of Americans do not have the cash on hand to deal with an unexpected $400.00 expense, without borrowing or selling something. Nearly 1/5 of those are people earning $80-100,000 per year. A much-cited reason for the lack of emergency savings is the amount of debt people carry, but a deeper dive reveals that the main problem involves our falling currency.

The SECURE Act

One of the features of the “SECURE” Act is the ability for younger Americans to draw money out of their retirement accounts to pay current living expenses, without a tax penalty. There are now many non-retirement expenses that can be paid penalty-free with retirement funds, and the SECURE Act expands that list of exceptions. But how does allowing people to spend their retirement funds in their 20’s and 30’s help them fund a secure retirement? It doesn’t. But it seeks to address a burgeoning currency problem, without acknowledging it as such.

There is a push in play for a new minimum wage of $15-$20 per hour (depending on which politician you ask). People are having trouble making ends meet on lesser amounts, while many employers would struggle to pay the new minimum. A case in point is the Bernie Sanders political campaign, who vocally advocates for a $15/hr minimum wage, while paying his own employees less. When called on the issue, the campaign responded with the solution of having employees work fewer hours. Unfortunately, this is what often happens to those already struggling to make ends meet - there is less work available at the new higher rate of pay.

We have written before about how having a currency with precious metals backing would largely solve this problem. If minimum wage was still $1.25 as it was in the early 60’s, and still paid with silver quarters, it would offer employees the purchasing power of today’s $22/hr (silver melt value in todays currency), and employers the expense of only $1.25 per hour. Talk about a win-win; stable purchasing power for everyone, and stable labor costs for employers. Instead, we have raised the minimum wage 22 times, and must raise it again and again just to keep up with a falling US Dollar.

One thing we have learned in over 25 years of financial consulting, is that people need a short-term emergency fund before they start a retirement account. Otherwise, they are tempted to draw funds out of retirement to pay for current living expenses - thereby defeating the purpose of having a retirement account. The SECURE Act makes retirement for many less secure, by encouraging young adults to spend their retirement funds for current living expenses. Even without a tax “penalty” on withdrawn funds, there are still penalties and fees likely for pulling funds out of long-term investments. There are also taxes that must be paid in the year the funds are withdrawn for non-retirement expenses.

STRETCH IRAs

Another strategy we have often used is to help clients set up STRETCH IRA’s, which allow them pass down retirement assets to family members with minimal taxation - thereby strengthening the retirement security of future generations of families. The SECURE Act lays waste to such responsible planning, by forcing beneficiaries to draw all funds out (and pay taxes on them) in just a few years. This will in many cases not only harm future retirement security for the intended family members, but also cause them to pay higher taxes on wages earned when they inherit the retirement funds. For these reasons and others, I believe the SECURE Act in it’s current form will do more to create retirement insecurity than security. It will also increase the coffers of Wall Street (through fees), and government (through taxation), at the expense of those (the American public) it claims to help.

You may have also heard about how Congress has moved to cover the pensions for various union pension plans that are going broke. Instead of addressing the problem to the asset managers and union bosses responsible for the shortfalls, they are making you and I responsible for paying the difference. Retirement security for a few, at the expense of the many. But increasingly it seems, government is seeking to produce retirement security for the many, at the expense of a few. Many states and municipalities have also made outlandish retirement promises they can’t keep, and will be looking to Congress to bail them out too.

The Looming Retirement Crisis

The looming “retirement crisis” that the SECURE Act seeks to address, will do little to provide retirement security for Americans, unless we address the currency issues often discussed. We recently told you about a new plan being considered by Congress to reintroduce precious metals to our currency, and one of the new nominees to the Federal Reserve Board (Judy Shelton) is a precious metals advocate. So, there is always hope. But there are also competing voices in Washington, who prefer to kick the can further down the road rather than deal with it now. The “temporary” closure of the gold trading window has lasted 48 years so far, for example. This means we must take action personally, in order to obtain future income security for ourselves and our families.

Whether you want to include precious metals as part of your formal retirement assets, or keep them separate, the professionals at the US Gold Bureau are here to help. Something to remember about Gold and Silver, is that it does not need to be in an IRA in order to be tax-deferred. Precious metals investing can be an effective and tax-efficient way to fund future retirement spending, and help provide financial security for current and future generations.

Posting in: